Alpha hunting is systematically finding mispriced opportunities before they become consensus. In crypto, that means catching early signals across chains, social, and market microstructure — then acting with conviction while the window is still open. In practice, you’re not waiting for a single “big signal”; you’re lining up several small ones—onchain intent, flow, price structure, and sentiment—until they form a coherent, testable thesis.

Most traders see the same feeds at the same time. By the point “news” hits mainstream sources or price action is obvious, edge is gone. Real alpha requires:

Neurobro is a networked intelligence for crypto designed to solve a simple problem: there’s too much data and not enough synthesis.

Aligned AI + Custom Data = Alpha.

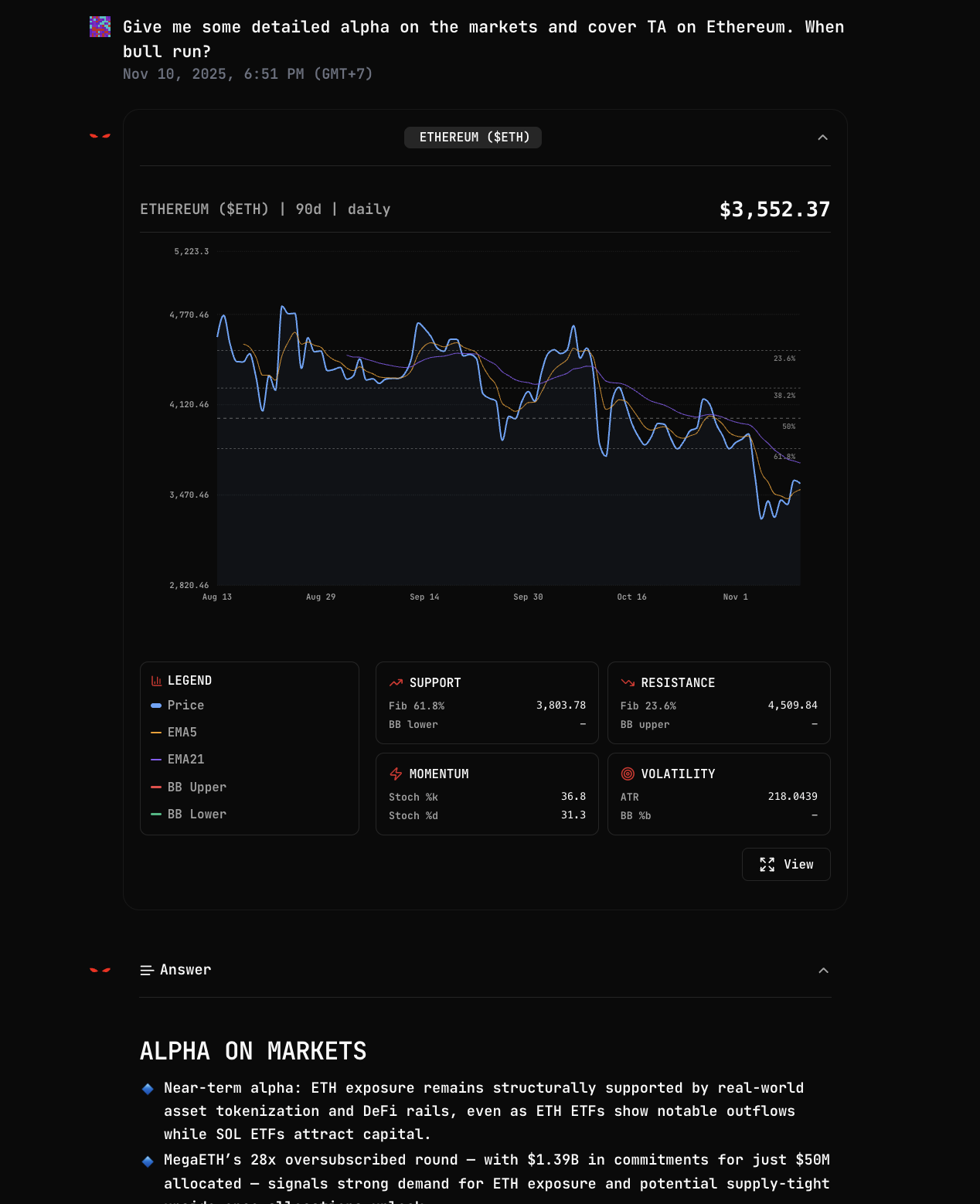

We pair a specialized AI research agent with real-time market intelligence to surface early, verifiable signals. Under the hood, Neurobro coordinates many expert AI agents (“Nevrons”) that specialize across four layers:

Neurobro plans your research, asks the right Nevrons, reconciles disagreements, and returns a concise response with linked sources & findings.

When you ask a question, Neurobro maps out a simple plan, sends small tasks to the right Nevrons, gathers the proof (charts, transactions, links), checks for conflicts, and comes back with one clear answer - fully sourced & verified.

It works because each layer sees a different side of the market. By lining up many small signals into a single story, Neurobro cuts noise and highlights what matters: who is moving, where pressure is building, and when the setup is likely to play out. Every answer includes links and artifacts, so you can click through to the chart, statement, or transaction and verify it yourself.

Neurobro removes the real‑world friction that leads to missed entries and late exits. It scans noisy streams (crypto twitter, public telegram channels, KOLs, onchain flows, etc.) and turns them into a small, clear set of ideas - with plain reasons you can act on.

Here are just some concrete examples of what Neurobro can find:

Neurobro keeps a live watchlist of active ideas and updates each response as conditions improve or break - no need to restart from scratch. For example: a returning whale rotates into mid‑cap L2s while funding stays negative and price grinds up → squeeze risk rises;

CEX inflows spike while team outflows stall and DEX liquidity deepens → accumulation more likely than distribution;

Narrative momentum for AI‑agents rises but on‑chain users and fee revenue lag → don’t chase - wait for specific growth triggers.

You get early opportunity flags - high-signal events surfaced before they hit CT and public dashboards - so promising moves are visible while the window is still open.

You also get smart-money tracking that concentrates on entities with a repeatable edge, filtering out random whale noise and focusing on flows that actually move markets.

Neurobro fuses onchain intent with market structure to refine timing and improve entry quality, connecting cause and effect rather than reacting to headlines or price alone.

Findings arrive as clear, actionable messages with context, setup structure, and explicit risk notes, so you understand the thesis, what confirms it, and what would invalidate it.

Built for active crypto traders, researchers and absolutely anyone who need fast, reliable edge in crypto markets.

Designed with simplicity in mind for trading communities, investors & beginners that want to start hunting real alpha through data-driven approach.

Useful for projects and funds that need always-on market intelligence to monitor smart money flows, sentiment, narratives, and risk.

Experience the power of Neurodex

Launch Neurodex →